Our Company

We’ve spent more than 20 years providing plan sponsors and health plans with an alternative to spread-based PBMs, and today we proudly serve almost 18 million members through almost 800 clients.

Pass-through

Model

Financial and Operational Transparency

Commitment to More Affordable Medications

About Us

Our Legacy

We’ve led the way as a market-ready model for transparent, fully pass-through pharmacy benefits management for more than 20 years—successfully disrupting the industry and setting the bar for financial and operational transparency.

We’re proud of the work we do and our strategic offerings that:

Return 100% of all negotiated rebates, discounts and fees back to our clients

Provide full financial and operational disclosures

Lower overall drug spend and cost of care

Improve medication adherence and member health

Offer alternative treatment options that can reduce long-term drug reliance

aligned values

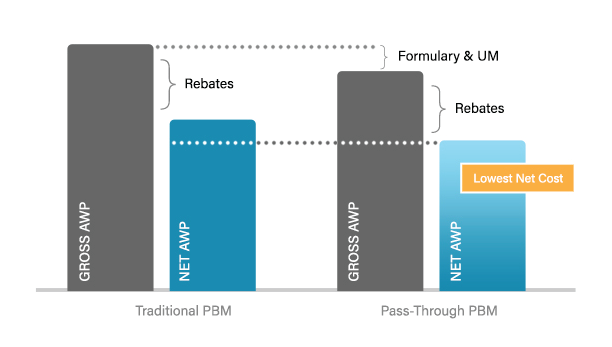

100% Pass-through Approach

No rebate chasing. No spread chasing.

Just a clear, easy-to-understand, set fee.

Which means as a pass-through model PBM, we’re able to make decisions that align with your organization’s goals, regardless of the potential impact to spread, margins or rebate dollars.

Because we don’t benefit when medication prices increase, our actions are guided by lowering overall drug spend, supporting your organization’s unique financial and operational needs, and ensuring that members can receive the care they need at a price they can afford.

true partnership

100% Financial and Operational Transparency

Transparency is more than just a buzzword. It’s our standard.

Without spread pricing to influence things, our clients experience transparency that empowers them to make well-informed decisions for their plans and their members.

Our clients have a clear understanding of their contract, terms, claim-level data and reporting, our financials and access to participate in our formulary management process.

a clear choice

How Transparent is Your PBM?

Think you have a clear understanding of what it means to operate with complete transparency? See how your current PBM stacks up against some of our core requirements for financial and operational transparency:

Revenue sources

- Does your PBM generate zero spread revenue on pharmacy or manufacturer claims?

- Does your plan immediately benefit and receive 100% of all network and pharma contract improvements?

- Does your plan receive 100% pass through of all rebates and discounts, including any upside or increased savings through the contract?

- Are 100% of all pharmacy costs passed back to your plan (in retail, mail and specialty channels)?

- Is formulary product selection based on a lowest-net-cost philosophy (not focused on higher costs to get more rebates)?

Contract Definitions

- Does your PBM use independent, publicly verified third-party definitions for brands and generics?

- For generics, is a single MAC list applied across all distribution channels?

- Is your PBM contract free of any incentives that benefit the PBM from the relationship between plan sponsor, PBM and patient?

- Do your utilization management (UM) programs have appropriate prior authorization (PA) approvals and step therapy used to manage cost, not generate revenue for PBM?

Contract Transparency

- For three-year contracts (or longer), are plan admin costs the same for each year and are they known up-front (rather than a contract where year two and three costs escalate after year one)?

- Do you have complete control over all aspects of your pharmacy benefit, including network/distribution channels and formulary?

- Do you have the ability to terminate the contract without cause after the first year and keep your rebates?

- Do you have unrestricted access to pharmaceutical manufacturer and pharmacy contracts?

Access to Data

- Do you have access to your data at any time with the same data sets used for auditing or financial guarantee true-ups?

- Do you have access to all claims data down to the NDC-11 level?

- Do you have access to all MAC lists used and clarity to how and when they’ll be used?

Auditing

- Do you have access to review and audit all documents and data pertaining to your benefit program?

- Do you have access to view and audit all network pharmacy arrangements?

- Do you have access to actual and total claim files for audit purposes (rather than separate and partial claim files)?

- Do you have access to actual net claim files for audit purposes including all claim calculations?

- Do you have access to view and audit all manufacturer contracts?

Service Excellence

Commitment to Care

Without the influence of chasing spread, we’re able to better position ourselves and our clients to do what matters most: help human beings get the care they need at a price they can afford.

Members are more than just a number

At Navitus, we know that affordable prescription drugs can be life-changing—and lifesaving. We are on a mission to make a real difference in our customers’ lives. Because behind every member ID is a real person, and they deserve to be treated like one.

Our Team

We work relentlessly to increase affordability and access to the medications people need. This commitment takes courage, persistence and a dedication to doing what’s right for the people we serve.

When you choose Navitus, your team expands to include experts committed to this mission who align to support your goals. Because for us, our business isn’t just business. People’s livelihoods and well-being depend on it.

-

Laura S. Kaiser

Chair of the Board

Laura S. Kaiser

Chair of the Board

President & Chief Executive Officer, SSM Health

As President and Chief Executive Officer of SSM Health, Laura S. Kaiser, FACHE, leads a Catholic not-for-profit health system serving communities across the Midwest through a robust and fully integrated health care delivery system. Headquartered in St. Louis, SSM Health includes 23 hospitals, more than 290 physician offices and other outpatient and virtual care services, 10 post-acute facilities, comprehensive home care and hospice services, a pharmacy benefit company, a health insurance company and an accountable care organization.

Laura joined SSM Health in 2017, bringing 30+ years of experience in health care strategy, improving clinical quality, fueling innovation, managing operational performance and growth, leading change management and successfully facilitating health care integration.

Laura previously served as Executive Vice President and Chief Operating Officer for Intermountain Healthcare. She also served at Ascension Health in a number of senior leadership roles, including President/CEO at Sacred Heart Health System.

She currently serves on several boards, including the American Hospital Association Health System Council, the Catholic Health Association, the Healthcare Leadership Council, Nuance Communications, Embold Health, the Scottsdale Institute and Civic Progress.

Laura earned a Bachelor of Science from the University of Missouri, a Master of Business Administration and a Master of Healthcare Administration from Saint Louis University. She is a Fellow of the American College of Healthcare Executives, and in 2018 and 2019 was named one of the “100 Most Influential People in Healthcare” by Modern Healthcare magazine.

-

David Fields

Board Member

David Fields

Board Member

President & CEO, Navitus Health Solutions

As President and CEO, David provides enterprise leadership and strategic direction for Navitus to drive its continued growth. He is responsible for external relationships such as industry thought-leader engagement, media interaction, and potential and current client strategies and support. David collaborates with the executive management team to maintain Navitus’ strategic plan and to develop and direct its goals, policies and execution.

Prior to joining Navitus, David served as President of Dean Health Plan, where he led the operations and continued growth of one of the largest HMOs in the Midwest, with a network of more than 4,000 practitioners at nearly 200 primary care sites and 28 hospitals. David has also served as Executive Vice President—Markets at Blue Shield of California, where he managed a nearly $20 billion, 4-million member non-profit health plan. He has previously held executive roles at Aetna, Coventry, Anthem and Humana, where he oversaw a health plan that included a 110-physician, multi-specialty group practice. David began his career as a CPA, providing auditing services for publicly traded hospital and insurance clients.

David has held leadership positions on a number of boards, including the American Heart Association, American Red Cross, Labor-Management Council and the National Conference of Christians and Jews. He earned a degree in accounting from the University of Louisville and has completed executive education at Duke University and Harvard University.

-

Richard Stephens, RPh

Vice Chair of Navitus

Richard Stephens, RPh

Vice Chair of Navitus

Senior Vice President of Pharmacy, Costco Wholesale Corporation

Richard Stephens, RPh is the Senior Vice President of Pharmacy for Costco Wholesale. He reports to Ron Vachris, President of Costco Wholesale. Richard’s responsibilities include overseeing the operation of 550+ pharmacies in the U.S. as well as the purchasing of Rx/Prescription and Over the Counter non-prescription products carried at Costco.

Richard started his retail and professional career as a pharmacist at Eckerd Drug in Dallas—Fort Worth, Texas. Over 10 years, Richard rose from staff pharmacist to pharmacy manager at several high-volume locations before finally becoming the Regional Pharmacy Supervisor, overseeing 30 high volume pharmacies in the Dallas—Fort Worth area. In 2001, Richard joined Costco as a pharmacy manager of Costco’s Ft. Worth location.

During his 21+ years at Costco, Richard has held positions as Pharmacy Manager, Regional Pharmacy Supervisor for the Texas region, AGMM, AVP and Vice President of Pharmacy Operations.

An Oklahoma native, Richard earned a Bachelor of Science in pharmacy from Southwestern Oklahoma State University in Weatherford Oklahoma.

-

Randy Combs

Board Member

Randy Combs

Board Member

Executive Advisor

As recently retired Chief Financial Officer of SSM Health, a $10 billion Catholic not-for-profit health system serving communities across the Midwest, Randy Combs was responsible for the direction and oversight of all financial services, including long-term positioning, mergers and acquisitions, operational finance, financial and regulatory reporting, managed care and revenue cycle management, internal audit, financial planning, capital management, bond financing and investment activities. He was also responsible for information technology, analytics and health plan activities.

Randy has more than 30 years of senior leadership experience in health care strategy, finance and operations. Throughout his career, he has led a number of successful partnerships, acquisitions, divestitures and other significant transactions, including bond offerings.

Randy comes from Navvis, SSM Health’s population health partner, where he was the Chief Financial and Administrative Officer. Prior to joining Navvis, Randy served in Chief Financial Officer roles at Mercy and KentuckyOne Health.

-

Lisa Erickson

Board Member

Lisa Erickson

Board Member

Lisa Erickson is the President and Chief Executive Officer of Medica. She is also a member of the Board of Directors of Medica Holding Company, which oversees our family of businesses, including Dean Health Plan.

Lisa joined Medica in 2023 as Chief Financial Officer. She has more than 30 years of experience in a wide range of industries.

Prior to Medica, Lisa was a Senior Vice President at Optum, where she led pharmacy network contracting and relationships, network operations, and pricing and underwriting. She also served as the Chief Financial Officer at OptumInsight, and in financial leadership roles at several other organizations, including Best Buy, General Mills, The Pillsbury Company, and TCF Bank.

Lisa is a member of the Board of Directors of the Animal Humane Society and previously served on the Board of Trustees for the Academy of Holy Angels.

She received a Bachelor of Business Administration with a major in Finance and Marketing from the University of Wisconsin-Madison and a Masters of Business Administration from the Carlson School of Business at the University of Minnesota.

-

Brad Hanna, PharmD

Board Member

Brad Hanna, PharmD

Board Member

Vice President of Pharmacy Operations, Costco Wholesale

Brad Hanna is the Vice President of Pharmacy Operations for Costco Wholesale. He reports to Richard Stephens, RPh, Senior Vice President of Costco Pharmacy. Brad’s responsibilities include managing the operation of 550+ pharmacies in the U.S. and merchandising non-prescription pharmacy related products.

Brad started his retail career with Costco in 1997 working as an Over the Counter pharmacy stocker and Pharmacy Technician. Brad graduated from University of the Pacific School of Pharmacy with his Pharm.D. and continued his career with Costco, working his way through various pharmacist positions.

During his 25+ years at Costco, Brad has held positions as Pharmacy Technician, Pharmacy Manager, Regional Pharmacy Supervisor for the Northwest region, AGMM, AVP and in 2021, was promoted to Vice President of Pharmacy Operations

-

Joseph Swedish

Board Member

Joseph Swedish

Board Member

Joseph R. Swedish is the former Chairman, President and CEO of Anthem, Inc, (currently Elevance Health) a Fortune 22 company and the nation’s leading health benefits provider. This became the foundation for Elevance Health today serving nearly 47.3 million members – or one in seven Americans – through its affiliated health plans, and over 117 million individuals across 33 states through its broad portfolio of health insurance and service subsidiaries.

He served as the Chairman, President and CEO from 2013 to 2018. Subsequently he served as a Strategic Advisor from 2018 to 2020. During his tenure Anthem’s membership grew by four million, or 11 percent, the average share price nearly quadrupled, and operating revenue increased 39 percent to over $89 billion. Core strategic imperatives included improving medical costs, working with physicians and health care organizations to improve quality and access, and improving the consumer experience.

As a business executive, conservationist, and philanthropist, Joe serves on the board of directors for CDW, Mesoblast – as Chairman, Centrexion Therapeutics, Accelus and Navitus Health Solutions. Most recently, he served on the board of directors for IBM, as chairman of America’s Health Insurance Plans (AHIP), and chairman of the Catholic Health Association. He currently serves as a board member for The Nature Conservancy (Colorado). He has also held board and advisory positions with American Hospital Association, Coventry Health Care, Inc., RehabCare Group, Inc., Cross Country, National Quality Forum, the National Center for Healthcare Leadership, and Loyola University Chicago. He is also a member and past chairman of Duke University’s Fuqua School of Business Board of Visitors.

Prior to joining Anthem, Joe served as CEO for several major integrated health care delivery systems, including president and CEO of Trinity Health, an 18-state integrated health care delivery system. He also held CEO and senior leadership positions with the Hospital Corporation of America, Colorado’s Centura Health, and integrated health systems in Florida, Virginia, and the Carolinas.

In 2018, he continued to apply his expertise leveraging his extensive health care experience as co-founder of Concord Health Partners, a private equity firm investing in data analytics, provider enablement services and consumer engagement enterprises. He is now Partner Emeritus having recently departed active status.

More broadly, he has built a reputation as a trend-setter by leveraging value-creating assets through high-performing governance, creative strategies, consumer marketing, clinical innovations, and mergers/acquisitions – all efforts focused on organization renewal and growth.

For 12 years in a row, Modern Healthcare named him one of the 100 Most Influential People in Healthcare, ranking in the top 20 of the health sector’s most senior-level executives, high-level government administrators, elected officials, academics, and thought-leaders for five consecutive years.

He received his bachelor’s degree from the University of North Carolina at Charlotte and his master’s degree in health administration from Duke University

-

David Fields

President & CEO

David Fields

Board Member

President & CEO

As President and CEO, David provides enterprise leadership and strategic direction for Navitus to drive its continued growth. He is responsible for external relationships such as industry thought-leader engagement, media interaction, and potential and current client strategies and support. David collaborates with the executive management team to maintain Navitus’ strategic plan and to develop and direct its goals, policies and execution.

Prior to joining Navitus, David served as President of Dean Health Plan, where he led the operations and continued growth of one of the largest HMOs in the Midwest, with a network of more than 4,000 practitioners at nearly 200 primary care sites and 28 hospitals. David has also served as Executive Vice President—Markets at Blue Shield of California, where he managed a nearly $20 billion, 4-million member non-profit health plan. He has previously held executive roles at Aetna, Coventry, Anthem and Humana, where he oversaw a health plan that included a 110-physician, multi-specialty group practice. David began his career as a CPA, providing auditing services for publicly traded hospital and insurance clients.

David has held leadership positions on a number of boards, including the American Heart Association, American Red Cross, Labor-Management Council and the National Conference of Christians and Jews. He earned a degree in accounting from the University of Louisville and has completed executive education at Duke University and Harvard University.

“I’m honored to lead this organization. Navitus is one of those rare companies that’s truly disrupting the industry and actively helping ensure that people across the nation have access to affordable prescription drug coverage.”

-

Carrie Aiken

Chief Administrative Officer

Carrie Aiken

Chief Administrative Officer

As Chief Administrative Officer, Carrie provides active leadership and support for the organization’s Human Resources, Corporate Compliance, Information Governance, and Fraud Programs.

In this role, Carrie is accountable for day-to-day implementation, performance and maintenance of company processes and controls.

Carrie has more than 25 years of experience across several health care disciplines, including physician, hospital, home health, and pharmacy, as well as contracting and revenue cycle. She has been involved with HIPAA since the inception of the privacy and security rules.

Carrie is certified in health care compliance through the Health Care Compliance Association (HCCA) and serves on the Board of Directors and Privacy Workgroup for the HIPAA Collaborative of Wisconsin.

“The foundations of our compliance and accreditation programs regularly exceeds the expectations of our clients while positioning Navitus for growth, innovation and emerging risk.”

-

Sharon Faust, PharmD, MBA, CSP

Chief Pharmacy Officer

Sharon Faust, PharmD, MBA, CSP

Chief Pharmacy Officer

As Chief Pharmacy Officer, Sharon oversees Health Strategies, Provider Services and Lumicera Health Services.

Within the Health Strategies division, Sharon’s accountability includes clinical and population health initiatives, drug utilization review programs, formulary and drug rebate management, and outcomes management. She is also accountable for Provider Services efforts, including developing, auditing and credentialing pharmacy networks that meet client access, discount and quality needs. This includes procurement strategies for pharmacy services through retail, mail and specialty channels to provide the best value to clients and members.

Sharon previously served as the Vice President, Specialty Pharmacy, at Lumicera Health Services. Lumicera is a subsidiary of Navitus and uniquely delivers a cost-plus model for specialty pharmacy.

Prior to joining the organization, Sharon worked as a clinical pharmacist in both retail and health system pharmacies. In these roles, she developed a clinical and patient-care foundation, conducting comprehensive medication reviews for patients with complex therapies and providing patient-centered consultations.

Sharon earned her Doctor of Pharmacy and Bachelor of Science degrees from the University of Wisconsin-Madison and her Master of Business Administration degree from the University of Wisconsin-Whitewater. She is a licensed pharmacist in Wisconsin and is on the Board of Directors for the National Association of Specialty Pharmacy and the Drug Selection Advisory Committee for CivicaScript. In 2023, she was awarded the top 50 most influential leaders in Pharmacy award presented by the Pharmacy Podcast network.

“Lumicera patient care representatives work closely with patients and their health care team to provide consultation, support and personalized care to improve health and deliver high-quality service. Our evidence-based clinical care programs are developed with the patient’s well-being in mind.”

-

George Hepburn

Chief Financial Officer

George Hepburn

Chief Financial Officer

As Senior Vice President & Chief Financial Officer, George is responsible for providing strategic leadership to establish long-range goals, strategies, plans and policies. In this role, George leads fiscal functions including finance and budgeting, analytics, investments and partnerships, accounting, AP/AR, payroll, and actuarial services and underwriting.

With over 25 years of senior executive experience in health care services and having worked for both Fortune 100 and private equity-backed companies, George brings a notable breadth and depth of expertise to Navitus. He is well versed to lead in accordance to Financial Accounting Standard Board principles as well as financial management techniques and practices appropriate within the healthcare industry and for private companies.

-

Diana G. Gibson Pace

Chief Growth Officer

Diana G. Gibson Pace

Chief Growth Officer

As Chief Growth Officer, Diana is accountable for business growth and expansion within markets that Navitus serves. She is a champion for customer centricity, providing leadership to further market-driven action, excellent service, and achievement of aligned goals. Her organization spans new sales and business development, proposals, marketing, implementation, client financial analysis, account management, and clinical account management.

Diana brings 30 years of experience managing accelerated business development in the health care space. Prior to joining Navitus, she served as Vice President and Chief Growth Officer at Aetna and Vice President and General Manager at Blue Shield of California.

She is a former director of the San Francisco Chamber of Commerce and served as a Court Appointed Special Advocate (CASA) in Alameda County, California. Diana holds a Master of Business Administration degree in marketing from the Anderson School of Management at UCLA and a bachelor’s degree from the University of California, Riverside.

“As plan sponsors, health plans, employers, labor unions and government entities increasingly look for greater transparency and both financial and clinical accountability, I’m excited to lead our amazing team as we grow at scale and expand our solutions.”

-

Darryl Munden

Chief Operating Officer

Darryl Munden

Chief Operating Officer

As Chief Operating Officer, Darryl is responsible for providing strategic direction and oversight for Navitus PBM operations and technology. This includes enabling technologies for core service capabilities, such as eligibility, claims administration and customer care operations. Additional areas of accountability include data quality and informatics, process automation, and customer and member digital experience.

Before joining the Navitus team Darryl served as CEO of MEACO Konnect after working at Rx Outreach for 11 years as COO and CEO. Darryl began his professional career as an officer in the United States Army. After his service in the military, he worked for Anheuser-Busch, later Anheuser-Busch InBev, for nearly 19 years in various positions. Before joining Rx Outreach, Darryl transitioned to Senior Director of Operations at Express Scripts.

Darryl has served on several non-profit Boards: Gifted Resource Council, NeedyMeds, Behavioral Health Network of Greater St. Louis, BJC Patient Care Committee and Missouri Baptist Medical Center. He currently serves as a Trustee at the University of Health Sciences and Pharmacy.

Darryl holds a Bachelor of Science degree in management information systems from Old Dominion University and a Master of Business Administration degree from Webster University.

-

Paul Page

Chief Legal Officer

Paul Page

Chief Legal Officer

As Navitus’ Chief Legal Officer, Paul manages legal matters related to the company, leading a team that provides expertise on legal and regulatory issues as well as government relations. His team focuses on business law, lobbying and advocacy, statutory and regulatory requirements, contracts, information technology and intellectual property, health care law, negotiations, corporate governance and mergers and acquisitions.

Prior to joining Navitus in 2014, Paul worked in private legal practice as a solo practitioner and at the law firm of Quarles & Brady. He also held various roles at Dean Health Systems.

Paul received his law degree from the University of Wisconsin Law School in Madison, graduating cum laude. He also earned a Master of Business Administration and a Bachelor of Science in biology from the University of Wisconsin — La Crosse. He is admitted to practice law in Wisconsin, the U.S. Patent and Trademark Office, and the U.S. District Courts of Eastern and Western Wisconsin.

-

Ben Heiser

General Manager, Specialty Pharmacy at Lumicera®

Ben Heiser

General Manager, Specialty Pharmacy at Lumicera®

Ben is General Manager of Specialty Pharmacy, at Lumicera Health Services, a wholly owned subsidiary of Navitus Health Solutions and a full-service national specialty pharmacy accredited by both URAC and ACHC. In this role, Ben provides strategic direction and oversight at Lumicera. His accountability includes operations, strategy and business development, and continuing to ensure that Lumicera delivers an exceptional specialty pharmacy program to meet the needs of their patients and partners.

Ben most recently served as Lumicera’s Vice President of Pharmacy Operations and Business Development. In this role, Ben utilized his experience and passion for operations to expand Lumicera’s capabilities and help grow the organization. Using his expertise in logistics, cold chain management, procurement and vendor management, Ben developed a specialty pharmacy fulfillment center of excellence, which has led to strategic engagements with national carriers and speaking engagements at some of the largest logistics conventions in the country.

Ben is a Certified Specialty Pharmacist and Lean Six Sigma Greenbelt. He received his Doctor of Pharmacy from the University of Wisconsin and his MBA from the University of Wisconsin — Madison.

-

Heather Sundar, PharmD

President & CEO of Archimedes

Heather Sundar, PharmD

President & CEO of Archimedes

As President and CEO of Archimedes, Heather provides vision and strategic direction for continued growth of Archimedes, a specialty drug management company that provides analytics, technology, and service solutions for employers, health plans, and health systems. She is responsible for industry thought leadership, forward leaning solutions, and alignment with clients to achieve their goals. Heather collaborates with the executive management team at the enterprise and board level.

Heather brings more than 20 years of experience to the role. She is a proven executive leader with an extensive portfolio of achievements. Prior to joining Archimedes, Heather demonstrated successful progression through a high-performance organization, serving as General Manager and Vice President of Product and Research at Express Scripts. Among her many initiatives during her 16-year tenure at Express Scripts, Heather had leading roles in acquisition integrations, clinical thought leadership and new product launches. She is named on 2 patents through her work.

Heather made the move to Archimedes to align with the payers. Given the skyrocketing cost of pharmacy benefits and the expectation that specialty drug spend would exceed 50% of the benefit, it was evident to her that it was time to challenge the status quo. At Archimedes, Heather has been able to work with billions of dollars of drug spend across both the pharmacy and the medical benefits, providing guidance and solutions for plans looking for ways to maintain high quality clinical care at an appropriate price. Taking this pragmatic and aligned approach, Heather has been successful at savings clients millions of wasted dollars in specialty drug management. As an influencer, Heather has led many market-changing solutions through her work with Archimedes, paving the way for more sustainable pharmacy and medical specialty drug benefits.

Heather has co-authored and published thought leadership pieces on pharmacy benefit management and industry changing strategies. She has received pharmacy leadership awards from St. Louis College of Pharmacy. Heather holds a Doctor of Pharmacy degree from St. Louis College of Pharmacy and completed a specialized pharmacy residency at St. Louis College of Pharmacy after graduation.

“Plan sponsors do not have to accept the status quo; there are solutions to help keep the specialty drug benefits affordable and sustainable.”

Interested in learning more about Navitus?

Latest Insights

Our latest insights, testimonials and more:

Pass-Through PBM Partnership Value

Prior to implementing the Navitus Key solution (formerly EpiphanyRx), a mid-size employer in the food industry was grappling with substantial year-over-year increases in per member per month (PMPM) pharmacy costs. The organization struggles to understand

Achieving Outstanding Results with Tailored Network Strategies

A medium-sized city in Michigan with 1,350 members was seeking ways to lower its pharmacy benefit costs, which were growing under its existing traditional pharmacy benefit manager (PBM). With its member covered by a two-tier, open formulary including

Breaking Through Barriers with Value-Based Plan Design

Facing increased pharmacy benefit expenses, Blain’s Farm and Fleet, a Midwestern employer group, desired to improve plan performance. Specifically it was interested in educating eligible members about the benefits available to them, promoting cost-effective

Finding a Solution to Lower Prescription Drug Costs

The Rural Arizona Group Health Trust (RAGHT) wanted to gain better control of its escalating drug trend with its large, traditional pharmacy benefit manager (PBM). Having only worked with traditional PBMs in the past, RAGHT was interested in exploring

Empowered by Strategic Opportunities and Service Excellence

Putnam | Northern Westchester Health Benefits Consortium (PNW HBC) was the first municipal cooperative health plan in the state of New York to become certified by the Department of Insurance. They are dedicated to meeting — and exceeding — the standards

QALYiQ Program Delivers Significant Savings for Both Members and Health Plans

As part of their treatment plan for hypophosphatasia (HPP), a rare genetic disorder affecting bone and teeth development, one of our members required Strensiq, a medication designed to manage HPP. However, Strensiq’s annual treatment costs ranged from

Gaining True Transparency With a Pass-Through PBM Model

Texas Association of Counties (TAC) was established to provide a cohesive voice for all counties and their officials. The counties joined together to establish a group health plan and employee benefits program known as the Health and Employee Benefits

Reducing Costs and Improving Service

Over time, one university grew increasingly dissatisfied with the service level it was receiving from its traditional pharmacy benefit manager (PBM). Despite the long-term relationship with its PBM, something needed to change.

Generating Plan and Member Savings Through Tailored Pharmacy Benefits

Seeking Customization and Cost Management for a Retiree Population Kentucky Rural Electric Cooperative (KREC) is a consortium of 13 nonprofit electric utility cooperatives. With a member population that includes retirees on the Medicare Part D prescription